Does ESG mean compromising performance?

Back in August 2019 (remember back then, when nobody had heard the word Covid?) the Investor’s Chronicle ran an article that asked the question, “Is ethical investing doomed?” Fast forward to now and the question appears very out-of-date.

Over the pandemic we’ve seen Environmental, Social and Governance (ESG) investing – a much broader scope than simply ethical - take off, with 2020 returns driven by investments in the tech giants that rose to the fore as people were confined to their homes and reliant on alternative ways to function.

Capital-lite (no dirty manufacturing plants), with data-centres often powered by green electricity and delivering products that are paperless and remove the need to travel, these tech giants were usually rated highly from an ESG perspective and enjoyed stellar growth during the period of social distancing.

ESG portfolios also benefitted in other ways in 2020, avoiding as they generally did oil & gas companies, during a time when prices collapsed, airlines, when no-one was flying and banks, when everyone was nervous about the economy.

With the restrictions that have plagued us for almost two years seemingly coming to an end, tech companies are now not flying quite so high and, given generally improving economies we’re seeing a renaissance for oil & gas, airlines and banks (particularly in January of 2022). So, should we expect ESG investing to return to the old perception of underperformance? We don’t think so given we now have some fairly long-term internal return data to support our thesis.

Take a long-term view

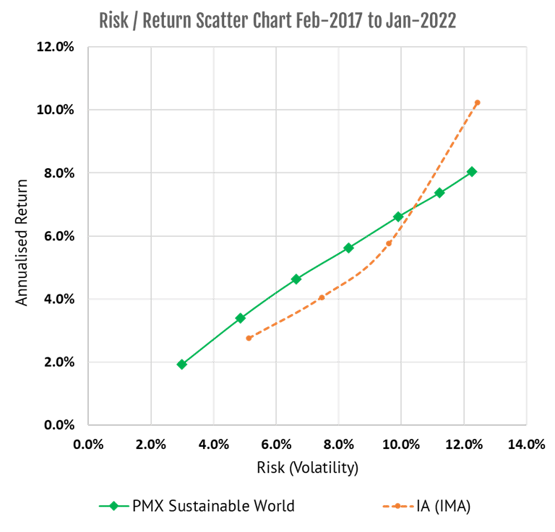

Few ESG investment providers have five-year performance stats to review, so we are in a good position to provide a longer comparison than most, with our Sustainable World portfolio now in its sixth year.

Analysis of the Sustainable World portfolios over the past five years shows investors enjoyed higher returns across the majority of risk bands compared to non-ESG portfolios*.

We don’t make the claim that ESG portfolio will outperform going forwards, but we do think this highlights the opportunities that exist for investors looking to make their money work harder for the good of the planet without necessarily sacrificing returns. For more links to the academic research on ESG performance, please see our whitepaper: ESG In Investing: Everything you wanted to know but were afraid to ask.

Future challenges

Obviously, as with any investments, caution is required and we have had some reversal of 2020’s out-performance in recent months given ESG’s bias towards underperforming quality and growth stylistics.

These challenges underline the complexities of ESG investing and the need for financial professionals to do their homework to ensure their clients are invested in funds that not only set out to offer good returns but which also meet the promised criteria.

Data Source: PortfolioMetrix and the Investment Association (IA). PMX Sustainable World inception on 23 January 2017. Performance is net of fund and PortfolioMetrix fees and is from 31 January 2017 to 31 January 2022. Risk is standard deviation of monthly returns.

Disclaimer: The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future performance.

Research by NextWealth for their ESG Tracker Study shows that just one fifth of financial advisers plan to fully integrate ESG investing into clients’ portfolios, with most preferring a core/satellite approach that uses ‘badged’ ESG solutions. Among financial advice professionals that are using badged funds, there is a strong preference for those named as ‘ESG’, ‘Ethical’ and ‘Sustainable.

All our portfolios take ESG considerations into account but over five years ago we realised advisers were looking for a dedicated ESG option that went even further, to introduce clients to the concept of sustainable – and not just ethical - investing.

Over the past 12-18 months we’ve seen a huge amount of new ESG fund launches but only time will tell if they can deliver the long-term results that they promise in their marketing blurb.

*Using Investment Association (IA) comparators. The IA https://www.theia.org/ is a trade body for UK Investment managers. They have created five sectors in which they group multi-asset funds (primarily UK based, but some offshore funds) to facilitate comparisons. The performance of the funds in each sector is then grouped to give a “benchmark return” for the sector. The sectors include a variety of funds including active and passive funds.