This is a guest blog from Brett Davidson of FP Advance as part of a series of blog posts in which we examine and unpack some of the common areas of practice management which financial advisers, who are often also business owners, need to act upon on as they strive to build and run a world class financial advice practice and deliver a superior client experience.

Brett Davidson is the Founder of FP Advance and the Uncover Your Business Potential programme. He helps great financial planners become great business people, so they can stay in love with their business and fulfil their potential.

Moving away from traditional, larger, up-front commission payments is the best thing you could ever do for yourself and your business.

I can say this without reservation because I’ve been through this process twice:

- Once in Australia when I transitioned my own business from a traditional model.

In 1994 we were a business with 8000 clients (5000 general insurance clients and 3000 life and pensions clients) many of whom we’d purchased in an attempt to grow. At that point, we had total annual revenues of about AUD $450,000.

Seven years later we had 250 clients, with total revenues of AUD $1.3M, of which $1M was recurring revenue.

- The second time I was part of this process was in the UK, where I’ve lived and worked as a business consultant to financial advisers for the last 18 years. I’ve helped hundreds and hundreds of firms make this change.

Why is this such a powerful business move?

It’s about alignment of interests.

All great advisers that I know genuinely care about their clients. That’s what makes them great advisers.

However, when you’re part of an industry that has forgotten about the client to a large extent you can find yourself having sleepless nights, asking yourself questions about the way you do business.

Eventually, you find yourself in a place thinking, there has got to be a better way.

The financial issues

There are some concerns about changing the business model.

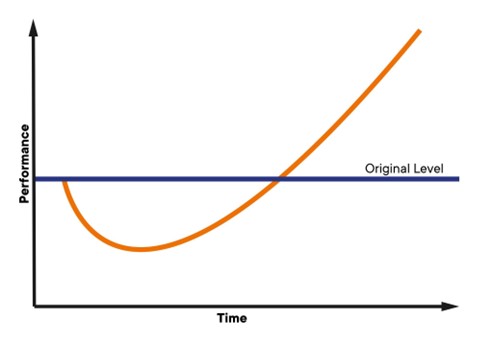

The number one concern is about your own finances; what we call the dreaded J-curve. That is if you stop taking larger up-front commission payments when you make a recommendation to a client, will you suffer a drop in income while you build a different fee model?

In my work with advisers, I insist that they plan for the dreaded J-curve by creating a forecast of projected revenues for the next year.

- How bad might it get?

- What’s the worst-case scenario?

- Can you survive it?

With some thought, all businesses can create a plan to get them through the worst-case scenario.

There are then some steps you need to work through before you launch your new approach:

Step 1: Think about your value proposition

What are you going to offer to your target market (or markets)?

The truth is most advisers do a ton of stuff that’s valuable for clients, although in the traditional industry model they only get paid when they sell something. All the other valuable work is not charged for. It’s given away for free to make a sale.

Here is a list of things that many advisers do for clients:

- Helping clients define their life goals

- Holding clients accountable to their life goals

- Cashflow modelling

- Education planning and funding

- Investment advice:

- Portfolio design

- Portfolio management

- Behavioural finance support

- Tax planning

- Budgeting

- Debt consolidation

- Risk management:

- Life insurance

- Income protection insurance

- Critical illness insurance

- Private health insurance

- Partnership insurance

- Key person insurance

- Mortgage advice

- One-page financial scorecard reporting

- Social security assistance

- Aged care planning (for parents, or for clients)

- Charitable giving and philanthropy

- Business succession planning

- Estate planning:

- Wills

- Lasting powers of attorney

- Trusts

- Inheritance tax planning

- Career counselling

- Share options planning

- Special needs planning:

- Trusts

- Funding

- Social security assistance

- Care

If you can package these services up effectively you can create a completely new way of working, where you get paid well for the ongoing value you deliver to your clients and the lifestyle outcomes you help them create.

If you’d like some more support on packaging up your value proposition take a look at this video.

Step 2: Think about your pricing approach

Only once you are clear on what you are offering in your new package of services can you then start thinking about your pricing.

Here are some conclusions you might come to:

- You can still charge for the up-front planning work and if you’re embracing cashflow modelling and asking great questions in the first part of the client engagement process, this is incredibly high-value work. Clients love it.

- You can also still charge something for implementing and putting the plan into action. Maybe it’s not the crazy front-loaded pricing of the old world, but it’s still got value.

- However, the most important part of your pricing is the ongoing fee for delivering annual reviews and keeping clients on track (or annual planning meetings as some advisers prefer to call them).

As you know in the UK, Australia, South Africa and the US, this fee for ongoing advice and support is often up to 1% of any assets under management depending on the range and level of service provided. And just to be clear, that means invested assets in financial products, not the client's property assets or cash accounts.

I realise in the Irish market right now that might feel like a bridge too far. BUT, my point is that you have to price yourself significantly higher than your competitors to reflect the fact you are a premium service, otherwise, it won’t make any sense in the client's mind.

The common misconception is that this increased ongoing advice fee is an investment charge - it’s not. It’s an all-in price for providing a holistic service that covers the wide range of services I outlined earlier. It works well for clients approaching, or already in retirement who have a reasonable amount of investable assets. It doesn’t work well for younger clients still in the accumulation phase of their lives.

You don’t have to charge a percentage-based ongoing advice fee, you could also elect to price the ongoing service as a flat fee. It’s up to you.

Remember, if you’ve done your packaging work well, the service you are offering looks and feels totally different to what the average adviser is doing.

If you’d like some more support on creating a new approach to pricing that’s right for your business then check this out.

Now make it work

Once your new pricing and packaging are all sorted then you can get started promoting your new approach and explaining to clients how aligned it is with their interests.

This message resonates. People are not stupid. Especially the better quality clients with more complex financial issues.

That shift allows you to increase the ongoing fees of most of your existing clients, which generates a big uptick in annual recurring revenue. Depending on what you charge right now, it might even double.

My experience

Most firms don’t actually suffer a massive downturn and J-curve effect, even in the first 12 months of the transition. The enthusiasm for their new approach generates plenty of work. Their more modest up-front charges make it easier for new clients to do business with them and the ongoing revenue grows as existing clients have their ongoing fees increased.

Heading into year 2 there is already a significant uptick in ongoing revenue and you never look back.

Is it time to consider your move to a more recurring revenue-based business model?

Let me know how you go.

I am delighted to say that I will be presenting at this year’s Irish PortfolioMetrix Investment Forum which will be held on October 13th at the Royal Marine Hotel, Dun Laoghaire in Co. Dublin. If you would like to come along and meet like-minded peers who are tackling similar issues within their businesses, then email mark.bradley@portfoliometrix.com to register your interest.

Check out this free webinar: Why Financial Planning Is Good For Your Business.