In a world of global investments, the debate around active versus passive should be overshadowed by the minus 6.8% per annum investors pay for specialised and thematic investing. Research has shown that this is what investors trade for the certainty and complexity of “exciting” investments, where good stories persuade us far more than facts.

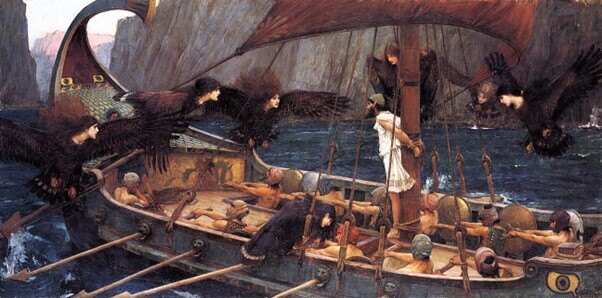

It starts with the story telling of the latest and greatest investment trends. An alluring call by the Sirens of the industry, promoting War Bonds, Penny Stocks, Real Estate, and Industrial and Technological revolutions. But when the story is told often the prize has already been claimed, leaving little for the investor as they set out on their own financial odyssey.

The Sirens of the industry

In the past, storytelling served as a means of sharing knowledge, culture, and even increased your chances of survival. Today storytelling serves investment sales teams the world over, exposing a key difference between what an investor really needs and what drives asset gatherers’ behaviour.

The modern-day investment stories, or narratives, that are told have taken the shape of crystal ball gazing, thematic, and revolutionary investing. But just like Odysseus in Homer’s poem, Odyssey, the successful investor will have bound their hands and resisted the Sirens’ call. Navigating the sometimes-rough seas, and not being drawn upon the rocky shores, will ultimately lead to a safe passage as you journey towards financial freedom and a comfortable retirement.

The temptation of the Sirens’ call lands your investments on rocky shores

Emotion is a powerful driver of action. Accessing this is naturally an effective sales trick, one with which global investment product providers are all too familiar. When Odysseus anticipated that he would face temptation beyond his control, he devised a plan to plug his sailors’ ears with beeswax to which they would reciprocate by tying his hands to the ships mast. This plan enabled them to ignore the sirens’ call, safely avoiding the rocky shores, and to proceed on their journey.

The sirens’ alluring songs symbolise the temptations of chasing short-term gains or following market hype. The call promotes investments in the latest artificial intelligence, industrial revolutions, digital currencies, and perhaps very niche technologies or sectors. But remember that asset gathers, and long-term investors have conflicting objectives, an antibiosis.

Morgan Housel spoke directly to why these investments appeal to investors when he wrote, “We crave certainty and are attracted to complexity. Good stories persuade us far more than facts”.

The true cost of the Sirens’ call is -6.8% per annum.

There is very little discourse around the ticket price we pay for the empty entertainment of these “good” stories. Properly considering the rewarding prospect of the “certainty” and attraction of complexity to which Housel refers to, is so often misunderstood. And so, it is also the area most neglected in this equation; the price paid.

In fact, there is sufficient evidence to place an explicit cost on this investment approach. A paper titled “Competition for Attention in the ETF Space”1 places this cost at minus 30%2, after accounting for the risk of these specialised investment themes over a period of five years!

It was only when Odysseus appeared calm that his sailors untied his hands

The analogy of Homer’s Odyssey extends further and speaks to closing the behaviour gap; Odysseus’s crew only untied his hands when he appeared to be calm, so just as Odysseus’s crew had their ears plugged with beeswax, investors must be disciplined and avoid impulsive decisions driven by emotion and the latest investment fad. The Sirens’ call currently leads to further concentration in an already concentrated market. Instead, a deliberate focus and a sound financial plan will keep you on course.

A safe passage in a world of fact and fiction

In its most extreme the Sirens’ call leads to boom and bust, but more frequently investment product providers thrive between these extremes, gathering assets at the expense of investors. And where better to perform this show than the global investment arena, with more than 9,000 ETFs3 and 130,000 mutual funds4 to choose from.

Even though these waters are well-charted, and the rocky shores are clear to see, investors preserve their behavioural biases and impulsive responses. Shedding some light on the common pitfalls investors make may encourage us all to plug our ears with beeswax, tie our hands to the mast, and sail safely on our journey through the Strait of Messina, ready to face the next challenges in the best financial position possible.

[¹] Ben-David, Itzhak and Franzoni, Francesco A. and Kim, Byungwook and Moussawi, Rabih, Competition for Attention in the ETF Space (January 2021). NBER Working Paper No. w28369, Available at SSRN: https://ssrn.com/abstract=3772608

[²] Risk-adjusted alpha using the broadly adopted Fama-French-Carhart four-factor model (FFC-4)

[³] Statista 2022 https://www.statista.com/statistics/278249/global-number-of-etfs/

[⁴] Statista 2023 https://www.statista.com/statistics/278303/number-of-mutual-funds-worldwide/