Flying in Formation: The Dynamic Relationship between Risk and Return

The primary responsibility of a firm managing a range of risk-controlled model portfolios or funds is to effectively meet the needs of the end investors. An integral aspect of this is constructing portfolios that consistently perform in accordance with their expected risk/reward trade-offs.

At PortfolioMetrix, we have developed a robust process that places the utmost emphasis on risk control and diversification, instilling confidence and delivering consistent results. We support investors’ financial plans by ensuring that our portfolio ranges 'fly in formation'.

Flying in formation

Flying in formation entails constructing portfolio ranges in which achieved returns are precisely correlated with the level of risk undertaken. For example, in a rising market, as the risk increases, so do the corresponding returns.

This approach holds immense significance as it enables advisers to select portfolios that align with their clients' risk budgets and, subsequently, exhibit behaviour in line with expectations.

The dynamic relationship between risk and return separation

Investment portfolio ranges are typically designed to cater for clients with a range of risk tolerance from low to high. The number of portfolios within a range varies but will typically run from Low Risk (often called “Cautious”) to Medium Risk (“Balanced”) to High Risk (“Aggressive” or “Assertive”).

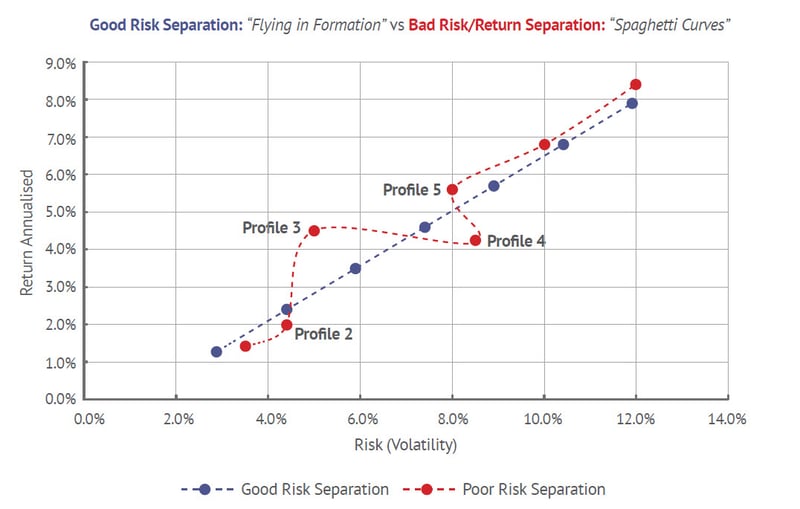

A range that flies in formation is one that displays a consistently spaced step-up in actual risk and returns between the various portfolios within the range. The chart below shows 2 hypothetical ranges.

- The Blue range displays good risk (horizontal axis) and return (vertical axis) separation – what we call Flying in Formation.

There is a consistent increase in risk between each portfolio (shown by a dot). - The Red range displays poor risk and return separation (sometimes referred to as Spaghetti Curves). The poor risk separation

is obvious between portfolios 2 to 5. The actual historical risk changes by +0.6%, +3.5% and -0.5% (highlighted

below). There are two issues: the actual risk not increasing consistently (the risk actually decreases between portfolios 4 and

5); and there is poor return separation (models 3 and 5 outperforming model 4).

Why is it important that a portfolio range flies in formation?

A portfolio range that flies in formation is important because it aligns with the financial planning process. A key part of this process is understanding the client’s ability and willingness to take risks, and then selecting a portfolio that correctly matches the client’s risk profile.

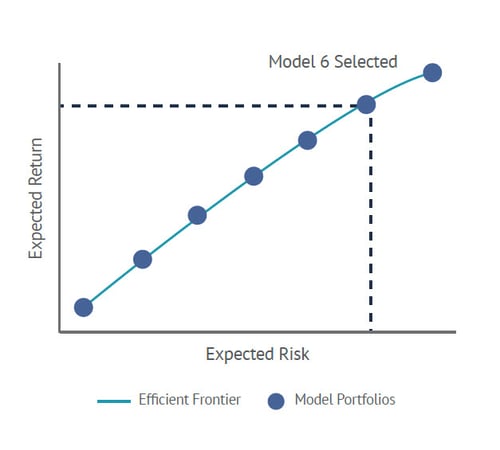

This part of the process involves explaining to the client the expected risk and return trade-off, as shown in the chart below. In other words, higher risk, over the long term, should lead to higher returns.

What if portfolio risk doesn't align with the expected risk?

The main aim of the investment manager should be to run a range of portfolios that behave consistently with this initial advice conversation (i.e. each portfolio ‘does what it says on the tin’).

If that doesn't happen, the journey may become so uncomfortable the client intervenes and never completes their financial journey (intervention risk). Conversely, if the risk is too low, the client may never reach their financial goal (shortfall risk).

Likewise, returns should increase consistently as the risk taken increases. A portfolio range that flies in formation doesn’t ‘break’ the advice process and ultimately helps clients stay the course of their investment plan to achieve their financial goals.

How does PortfolioMetrix build portfolio ranges that fly in formation?

Market returns are unpredictable. So, we focus our process first on what is easier to predict and control - risk.

Diversification then helps steer portfolio returns towards an outcome consistent with the risk taken as time goes on.

Step one uses our investment engineering skills to build portfolios that deliver predictable risk outcomes for clients over

the long run and consistent risk separation across the curve. This risk-based framework starts with defining our asset allocation,

which requires us to understand the risk characteristics of each asset class, including how they move together (correlation).

We then combine these asset classes together in a diversified way to achieve consistent risk separation across the entire curve and to generate more predictable returns at each risk level (the return on one asset class alone is very uncertain, but through the law of averages, the more you combine together the more predictable the returns of the portfolio).

We are then careful to implement the asset allocation using funds that closely match the characteristics of the asset class. This also leads us to avoid funds with unpredictable risk characteristics, such as some absolute return funds that are prone to large, unexpected falls in value due to their complexity.

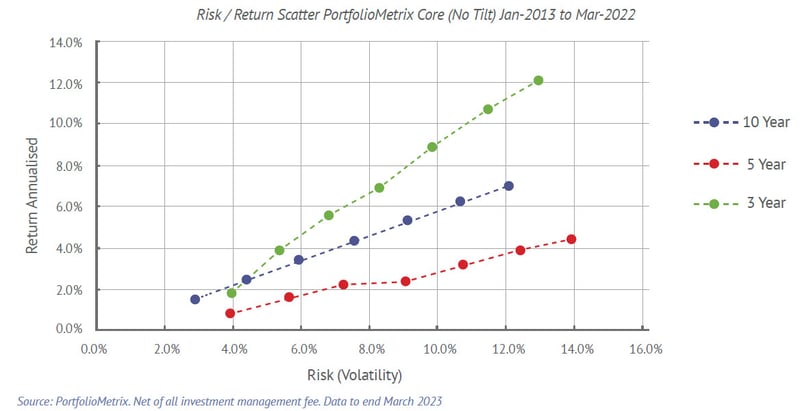

Ultimately, the proof is in the pudding and as the below chart shows, since the launch of our UK portfolios in 2013, we have delivered consistent risk separation across our solutions over every time period.

About Us

PortfolioMetrix is a global investment manager operating in the United Kingdom, South Africa, and Ireland. We support independent advisers to scale sustainably without compromising the quality of advice they provide to their clients.

Our risk-based investment process ensures carefully calibrated portfolios that deliver predictable outcomes specific to each investor. See how we partner with advisers.

Our technology, WealthExplorer™ allows the adviser to extract the synergies between financial advice and investment management, providing deeper client insights and more robust recommendations.

For more information, send us an email at engagement@portfoliometrix.co.uk

PortfolioMetrix cannot accept any liability for loss for doing so. The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future performance. Portfolio holdings and asset allocation can change at any time without notice. PortfolioMetrix Asset Management Ltd is authorised and regulated by the Financial Conduct Authority.