Platforms

Investment Flexibility

Over 50 portfolios* available to Irish investors covering:

- Passive Portfolios

- Active Portfolios

- Factor Based Portfolios

- Non-EU ETF (US ETFs)

- Sustainable Portfolios (ESG)

*Portfolios may be subject to exit Tax and/or CGT/ Income Tax depending on the investors' circumstances an where the portfolio is housed outside of tax wrapped environment e.g. a Pension. In all matters related to tax, investors are advised to always seek appropriate advice and guidance from a recognised specialist in the field.

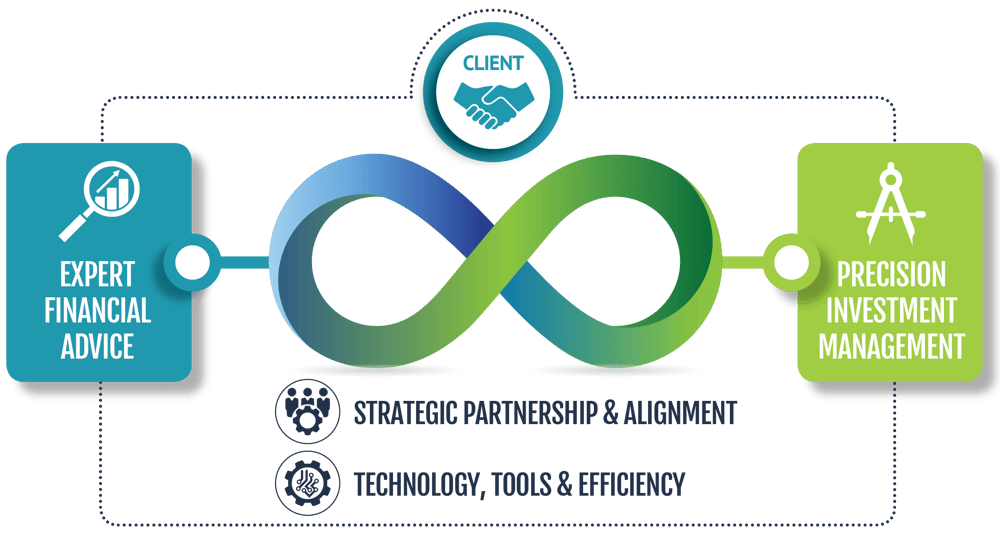

Why Partner with PortfolioMetrix?

- We are whole of market and our independence means we have no conflicts of interest when marketing fund selections

- We help advisers build a recurring income in their business and increase their enterprise value

- Partnering with PortfolioMetrix is more than a simple decision to choose technology. It means better investment outcomes for your clients, deeper client analysis, increased productivity and an opportunity to scale your business

Conexim Advisors Limited (“Conexim”) is authorised and regulated by the Central Bank of Ireland (the “Central Bank”) as an investment firm under the Markets in Financial Instruments Regulations 2017 (the “MiFID Regulations”). PortfolioMetrix Asset Management Limited UK (“PMAM”) provides Conexim with investment advice in relation to certain private investor client portfolios, as permitted under the MiFID Regulations. However, as PMAM is not authorised as an investment firm in the EU / EEA, it does not provide any investment services directly to retail or opt-up professional clients in Ireland. Conexim remains at all times fully responsible for the implementation or non-implementation of any advice it receives from PMAM.