Discretionary Powers

Using ours removes the workload and inefficiencies of running advisory models

Regulatory Constraints

We build models tailored to meet your clients' needs, helping you comply with regulatory requirements like PROD, MiFID-II and Consumer Duty

Branding

Insourcing enhances your brand and protects you against the threat from direct to consumer investment providers

Efficiency Gains

Many advisers can grow revenues, but few can grow profits at the same rate. lnsourcing delivers efficiency gains & time savings allowing your business to scale

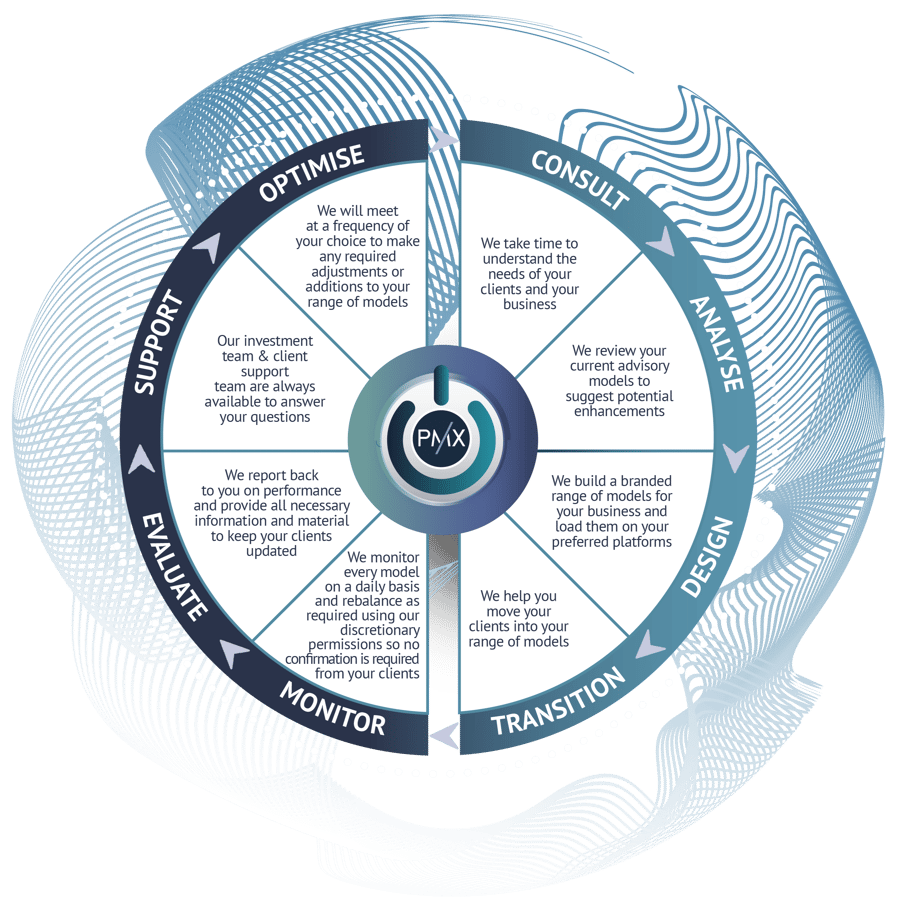

How Insourcing Works

PortfolioMetrix will create a risk-rated range of models, branded in your adviser firm's name. They are shaped by your investment philosophy, aligned to your preferred risk profiler and available on your selected platform(s).

This is evolution not revolution...

Insourcing aligns more closely with your existing proposition so it does not require as big a cultural shift as moving to full Outsourcing. This continuity means it is easier to explain to your clients and easier to adopt for your team.

Input Required

Ranges from 'check and challenge' to full involvement in asset allocation and fund selection

Meeting Attendance

Interactions range from formal investment committee meetings to informal investment report backs

Qualifying Criteria

Investment experience and clear investment philosophy required. We will need a minimum of 1-2 representatives for quarterly meetings

Regulatory Set Up

The adviser is not excercising discretion. Models are built using PortfolioMetrix's discretionary permissions

Flexibility

The PortfolioMetrix approach is about collaboration and not about imposing excessive restrictions. This means models are genuinely bespoke to your firm rather than 'off the shelf'

Model Optimisation

As your Insourcing partner, we don't start by critiquing your fund picks, instead we focus on asset allocation and model construction with a specific focus on improving outcomes for your clients

Risk Expertise

We've run our own risk profiler for over 10 years, so we know how to accurately map intent into action. We also have an established track record of delivering consistent outcomes when balancing risk and return

No threat to your business

PortfolioMetrix does not have any in-house advisers and we don't have a direct to consumer offering. This means there is no conflict of interest and reinforces our belief these are your clients.