In day-to-day life, we find many people who only buy a specific brand of clothes, go to the same store each time, or visit and shop on the same websites. These are all examples of the well documented behavioural heuristic; the familiarity bias in daily life.

When it comes to investing and retirement savings in Ireland, the retail landscape has traditionally been dominated by a small number of well-known life companies and stock brokers that spend a large amount of their resources each year advertising to the public in the national media. Is it any wonder then that clients can often fall foul of this same familiarity bias and favour an investment or pension product purely because they “have heard of that company”.

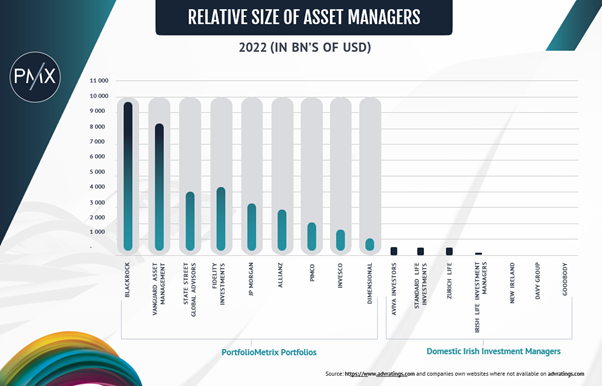

When it comes to investing, research, due diligence and decision making should stretch beyond familiarity. Many of the biggest investment companies on the planet do not advertise to end investors during the ad break of the 9 o’clock news. This makes them unfamiliar to end investors. Does that mean they should be omitted from consideration when it comes to deciding on an investment strategy?

Thanks to the open-architecture of investment platforms, a whole world of investment options are now open to Irish advisers and their clients.

At PortfolioMetrix we look behind the expensive advertising and brands. We work with specialist fund management groups, some of which are the world’s largest, to construct and manage client portfolios that stand the test of time for financial advisers and their clients.

Relative Size of Assets Under Management

Data correct as of June 2022